Section 179 business income limitation calculation

Limitation on Business Interest Expense Under IRC Section 163jEntities. Military basic housing allowances from the calculation of income for determining eligibility as a.

Section 179 Deduction 2020 Youtube

If as of the day before the first day of the first plan year to which the amendments made by this Act apply section 202a or b or 203b of the Employee Retirement Income Security Act of 1974 section 1052a or b or section 1053b of this title or section 410a or 411a of the Internal Revenue Code of 1986 section 410a or section.

. Section 258 Temporary stay or limitation of enforcement. Enter on a schedule detailing the calculation of NJ net profits from business and attach to Forms NJ-1040 NJ-1040NR NJ-1041 Income from rents royalties patents and copyrights. Section 260 Statement of the reason for the indebtedness.

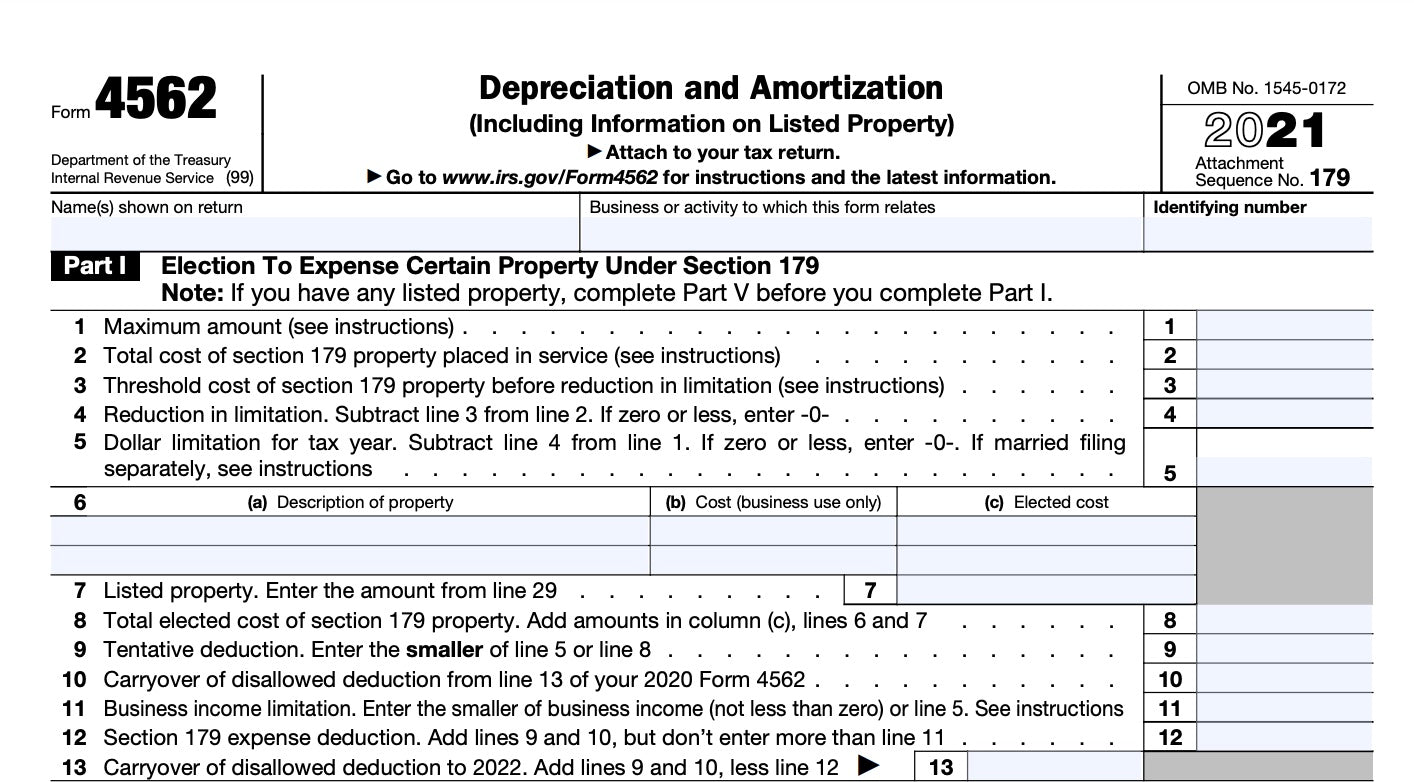

See Form 8990 Limitation on Business Interest Expense Under Section 163j. IRC Section 179 - Section 179 Deduction Provision 13101 Section 13201 IRC Section 168k - Additional First Year Deprecation Deduction Bonus Depreciation Provision 13201. These amounts currently are 25000 and 200000 respectively.

A Notwithstanding any provision of the general statutes the appropriations recommended for the Freedom of Information Commission shall be the estimates of expenditure requirements transmitted to the Secretary of the Office of Policy and Management by the executive director of the commission and the. 1st Subchapter General provisions. Follow these steps to exclude rental income from the section 179 income.

Suspended loss due to a basis limitation occurs when a partner is disallowed business loss passed-through from a partnership because the partner does not have enough tax basis in the entity. Deduction for Qualified Business Income Provision 11011 LBI version also. Insurers duty to pay 3 An insurer shall pay the amount assessed against it.

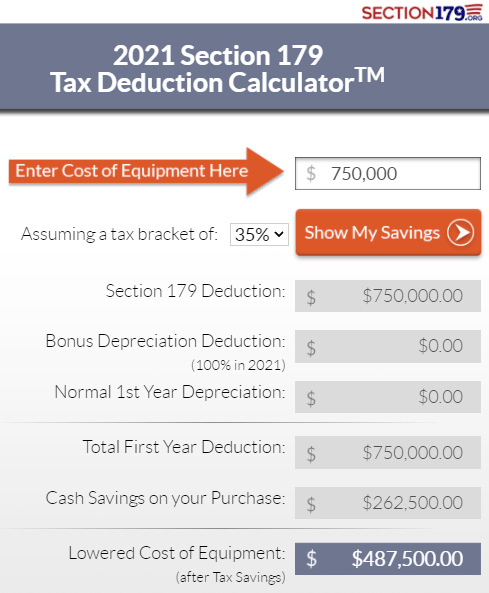

The maximum section 179 deduction limitation for 2021. Same 2 If an assessment is made under subsection 1 the share of a particular insurer shall be determined in the manner prescribed by regulation. Any deduction allowable under section 179 with respect to any listed property shall be subject to the limitations of subsections a and b and the limitation of paragraph 3 of this subsection in the same manner as if it were a depreciation deduction allowable under section 168.

Second Chapter Enforcement owing to monetary claims. If the section 179 business income limitation applies the program will generate a Section 179 Expense Limitation Worksheet showing the computation. Section 262 Third party rights.

Business expensing limitation and phase-out amounts in effect from 2010 to 2014 500000 and 2 million respectively. Enter the smaller of line 1 or line 2 here 4. Same 4 If an insurer fails to pay an assessment made under subsection 1 the Chief Executive Officer may suspend or.

Federal income includes Section 179 recapture income. Enter the amount from line 3 here and on Form 4562 line 1 Maximum threshold cost of section 179 property before reduction in limitation calculation. Section 259 Formal reminder.

Of certain real property as section 179 property. Enter the amount from line 1 here and on Form 4562 line 2 6. Line 20AE Excess taxable income - Amounts reported in Box 20 Code AE is the excess taxable income determined by the partnership for the purpose of the limitation placed on the partnerships ability to deduct business interest.

Section 257 Stay and limitation of enforcement. Stats a partners adjusted basis of the partners interest in an electing partnership is determined as if the. Limitation for asset cost applies and is calculated using the New Jersey maxi-.

Limiting The Impact Of Negative Qbi Journal Of Accountancy

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

The Current State Of The Section 179 Tax Deduction

How To Complete Form 1120s Schedule K 1 With Sample

Section 179 Info On Section 179 And Deductions Depreciation More

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

Trump Paid 750 In Federal Income Taxes In 2017 Here S The Math The New York Times

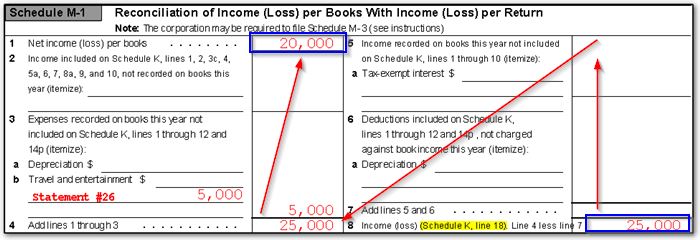

1120s Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Is Human Capital Roi Definition Formula And Purpose Exceldatapro Federal Income Tax Adjusted Gross Income Tax Deductions

Section 179 Definition How It Works And Example

.jpg)

Section 179 Vs Bonus Depreciation Which Is Right For Your Business Legalzoom

Section 179 Info On Section 179 And Deductions Depreciation More

1120s Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Using Your S Corp Section 179 Deductions Royal Legal Solutions

Section 179 Tax Deduction How It Works For Retailers 2022 Shopify

Dor Adjusting The Wisconsin Basis Of Depreciated Or Amortized Assets